Buying Life Insurance

Exactly just how to obtain life insurance: 7 actions towards buying the straight policy

Looking for life insurance protection does not have actually to become complex. Discover exactly just how dealing with an representative creates it simple towards use on the internet as well as obtain inexpensive life insurance for your household.

Life insurance produces monetary security for your liked ones if you pass away suddenly, however searching for the straight policy could be complicated. Our team described 7 simple actions listed below to assist you create essential choices as well as obtain life insurance easily: coming from identifying just the amount of protection you need towards choosing the kind of policy as well as contrasting estimates.

Key Takeaways

- Dealing with an private broker will help you discover one of the absolute most inexpensive service company.

- Financing typically consists of a telephone call as well as clinical exam, however some insurance providers as well as items waive the clinical exam.

- The request procedure could be finished mainly on the internet if you obtain no-medical-exam life insurance.

- You don't formally have actually protection up till you authorize your last policy files as well as pay out your very initial costs.

1. Calculate just the amount of life insurance you need

Life insurance protection ought to be actually personalized for your family's long-lasting monetary requirements, consisting of forecasted earnings, financial obligations, costs, as well as the requirements of your dependents. Policygenius professionals recommend 10 towards 15 opportunities your yearly earnings in life insurance protection towards sustain these sets you back for your household. You can easily utilize our personal digital assistant towards tally up just the amount of protection you need or even get to bent on a certified representative that will help you perform the mathematics.

Tally up your monetary responsibilities

Including up the sets you back listed below will certainly assist you obtain a feeling of exactly just what your household will certainly need if you are gone. Your fatality profit ought to include that whole buck quantity minus any type of fluid possessions you currently have actually. A common analysis may appear like this:

Recommended coverage example

Total financial obligations (Expenses + Debt): $1,446,377

Coverage gap (Total financial obligations - Assets): $1,269,049

Recommended coverage amount: $1,300,000

2. Choose exactly just what kind of policy you need

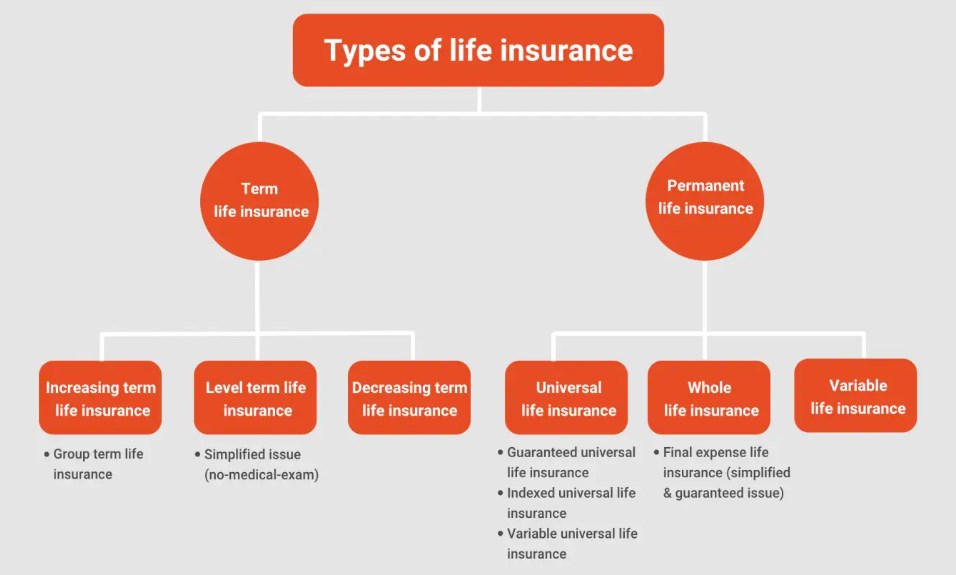

After assessing the quantity of protection you need, you can easily choose if you ought to purchase a phrase or even long-term life insurance policy. Phrase life insurance is actually the very best choice for many people — it is simple towards handle as well as provides one of the absolute most protection for the most affordable buck quantity. However certainly there certainly might be actually situations where you need a long-term life insurance policy — for instance, if somebody will certainly depend upon your financial backing for life.

If you are thinking about buying life insurance as component of your financial assets profile or even real property preparation technique, specific kinds of long-term life insurance plans, consisting of whole life insurance or even indexed global life insurance, could be a choice for you.

A Policygenius agent can help you decide on the best policy for your budget and coverage needs.

3. Look around for a life insurance policy

When you have actually a concept of the kind of protection you need, the following tip is actually towards choose where towards purchase life insurance. A frustrating bulk of individuals acquisition their policy coming from an insurance representative or even broker, however you can easily likewise acquisition it with a monetary consultant, a company, a company, or even straight coming from an insurance business. Brokers stand for you as well as have the tendency to deal much a lot extra impartial guidance, while representatives stand for the insurer's rate of passions.

Insurance prices are actually controlled through legislation, which implies that no business, broker, or even representative can easily deal you a discount rate on a policy. However since each insurance provider determines danger in a different way, you will pay out one of the absolute most inexpensive costs through looking around along with several insurance providers instead of dealing with simply one.

Inning accordance with a research study carried out through LIMRA, an private research study profession organization, over a fourth of life insurance purchasers discovered that dealing with an representative relieved the life insurance buying procedure, as well as 97% of the candidates checked skilled acceptable solution.

To obtain the very best prices as well as very most precise info offered throughout several insurance business, our team suggest dealing with an private broker. At Policygenius, our brokers are actually certified in each fifty conditions as well as can easily stroll you with the whole life insurance buying procedure while providing clear, impartial guidance.

Buying life insurance coming from a broker vs an representative

In some cases "representative" as well as "broker" are actually utilized interchangeably, however it is essential towards recognize all of them. Understanding the advantages and disadvantages of buying life insurance with each will certainly assist you discover a policy that strikes the straight equilibrium in between cost as well as security.

- Private brokers such as Policygenius are actually certainly not affiliated along with any type of insurance provider as well as offer plans coming from several business. They function in your place, complying with your request throughout the whole financing procedure, as well as looking around for options if your initial request leads to a greater costs compared to you were actually estimated or even a decrease. Dealing with a broker may get much a lot longer since they will need to contrast estimates throughout various business, particularly if you existing a number of danger elements for a life insurance provider to think about.

- Affiliated representatives, likewise referred to as captive representatives, are actually employed through several insurance providers towards offer their items. You may feeling much a lot extra comfy handling a regional representative, particularly if you've formerly dealt with all of them on various other insurance items. Representatives understand their company's offerings as well as request handling opportunities extremely well. Your choices will certainly be actually restricted as representatives just offer plans coming from the insurance providers they help. As well as since they're paid out on compensation, representatives might have actually a monetary reward towards offer you much a lot extra costly plans or even much a lot extra protection compared to you need.

Where more towards purchase life insurance

Certainly there certainly are actually various other methods towards acquisition life insurance, which might just be actually offered towards you if you are affiliated along with a particular company. Unless your company provides several service company choices — a rarity — the exact very same benefits as well as drawbacks of buying straight coming from an insurance business use.

- Straight coming from an insurance business: Some insurance business enable you towards put on their strategies straight, however you will have actually restricted choices towards select from as well as you will not obtain impartial guidance.

- With a monetary consultant: Dealing with a monetary consultant can easily assist guarantee that you select a policy that suits your budget plan as well as your monetary objectives.

- Coming from a company: Numerous companies or even various other companies, such as cooperative credit union, deal team life insurance, sometimes at no charge. Team plans typically deal restricted security, therefore you will most likely need towards acquisition your very own policy towards satisfy your protection requirements.

Contrast life insurance estimates as well as business

You can easily obtain a totally free example estimate coming from various insurance providers along with simply a couple of items of individual info, such as your place, grow older, sex, as well as fundamental clinical background.

Many people choose the most affordable policy that has actually the protection they need, however it is essential towards contrast various other functions, such as exactly just what bikers, or even additional protection, a business provides, their customer support document as well as scores coming from relied on 3rd party scores companies such as A.M. Finest, as well as whether they're finest for your specific health and wellness account.

4. Finish the request procedure

The request needs a telephone speak with where you will be actually inquired about your clinical background, way of life, as well as various other individual information. Life insurance business perform a comprehensive assessment of your clinical background as well as history, therefore if they discover one thing you really did not record, your real costs might appearance various compared to the preliminary estimate you got.

Insurance providers likewise inspect your life insurance request background for any type of problems — such as if you've ever before been actually captured resting on a request — as well as verify exactly just what you stated in your clinical background versus data sources such as the MIB.

Exactly just what concerns towards anticipate from your insurance provider

You might be actually inquired towards license your physician towards discuss your health and wellness info along with the life insurance business, referred to as an going to doctor declaration (APS). This info is actually required towards certainly not just obtain you the appropriate policy however might likewise make you much a lot extra inexpensive costs if you have actually a health and wellness problem however your physician records that you've reacted effectively towards therapy.

Furthermore, you will be actually inquired about your pastimes as well as monetary health and wellness — consisting of your earnings as well as total assets — in addition to various other life insurance plans you have actually.

Exactly just what files you will need

You can easily create the request procedure as smooth as feasible through possessing essential info available prior to you request life insurance. None of the complying with files are actually needed towards request life insurance however might assist accelerate the preliminary telecall. These consist of:

- Evidence of identification, citizenship, as well as grow older. A driver's permit, Social Safety and safety variety, birth certification, or even a legitimate ticket will certainly function. Noncitizen locals can easily utilize their permit (long-term local memory card) or even an work permission memory card.

- Evidence of earnings. You can easily utilize pay out stubs, a character of work, a tax obligation gain, or even an profits declaration coming from your financial institution. If you are unemployed, an unemployment character or even regular month-to-month declaration explaining your unemployment advantages will certainly function.

- Evidence of residency. For tenants, that might be your authorized rent or even a lease invoice. For property owners, your home loan expense or even a residential or commercial property tax obligation declaration will certainly be enough. Insurance providers will certainly likewise acknowledge a energy expense or even a postmarked pouch along with your gain deal with on it.

Insurance business don't gather any one of the files noted over, however possessing all of them before you'll conserve opportunity for you as well as the insurance provider.

5. Obtain a clinical exam

If you choose towards go the conventional path, you will routine your clinical exam after your telephone speak with. The life insurance clinical exam is actually a totally free exam just like a annual bodily, along with a choice for the clinical inspector to find for your office or home.

If you choose a no-medical-exam life insurance policy, after that the insurance provider will certainly remain to check out your clinical background (you will need towards authorize a HIPAA conformity waiver towards provide accessibility for your documents) as well as connect when they've chosen your policy.

6. Wait on the financing outcomes

The difficult component mores than — currently all of you need to perform is actually hold your horses. Financing, which encapsulates the request, telecall, as well as clinical exam, is actually exactly just how the life insurance business assesses the danger of guaranteeing you as well as just the amount of you will spend for your policy. When it is over, an expert will certainly identify your health and wellness category as well as last costs.

This procedure can easily get 5 towards 6 full weeks, however in some cases much a lot longer if component of your request need any type of additional paperwork (such as an APS).

7. Authorize the files as well as spend for your policy

When the financing procedure is actually finish, you will be actually provided a policy deal. If you consent to its own phrases, everything is actually left behind is actually for you towards authorize the policy files as well as pay out your very initial costs. Your policy isn't really in pressure up till you do this — a policy deal coming from the insurance provider does not imply you have actually protection.

Exactly just what to perform along with your policy files

Depending upon the insurance provider, your policy files will certainly either need to become digitally provided or even sent by mail rear. Maintain a difficult duplicate as well as electronic duplicate of your policy in a refuge as well as allow your recipients where towards discover it. If your recipients do not learn about the policy, they will not understand ways to insurance case the fatality profit.

Obtaining life insurance can easily feeling frustrating, however if you understand exactly just what towards anticipate as well as deal with a well-informed broker, you can easily obtain the protection you need rapidly as well as effectively.